Expert Systems Announces FY24 Annual Results

Two Core Businesses Achieve Growth Steady Progress in AI Business

* * * *

(26 June 2024, Hong Kong) — Expert Systems Holdings Limited (“Expert Systems” or the “Group”; Stock code: 8319), a leading technology and innovation company in the Asia Pacific region, announced the audited annual results of the Company and its subsidiaries (the “Group”) for the year ended 31 March 2024 (the “Reporting Year”).

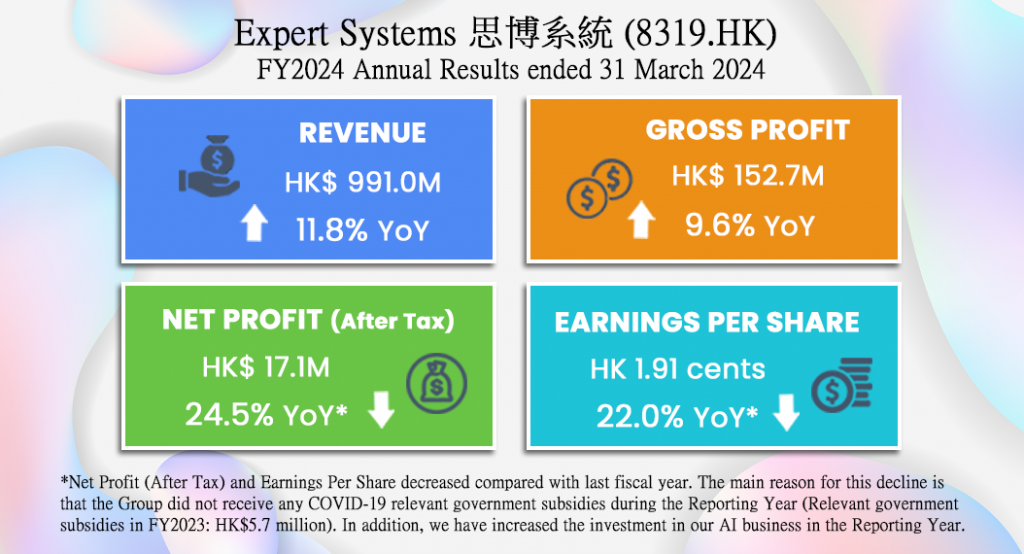

During the Reporting Year, the Group’s revenue increased by 11.8% to approximately HK$991.0 million driven by the increase in customer demand. Gross profit amounted to HK$152.7 million, representing an year-on-year increase of 9.6%. Gross profit margin remained stable at approximately 15.4% (FY2023: 15.7%). Profit for the year of the Company recorded HK$17.1 million (FY2023: HK$22.7million), representing a decrease of approximately HK$5.6 million year-on-year. The main reason for this decline is that the Group did not receive any COVID-19 relevant government subsidies during the Reporting Year (Relevant government subsidies in FY2023: HK$5.7 million). In additional, we have increased the investment to our AI business in the Reporting Year.

The Board recommends a final dividend of HK0.82 cent (FY2023: HK1.00 cent) per ordinary share, resulting in a dividend payout ratio of 42.86%. The payment of the final dividend is subject to the approval of the shareholders at the forthcoming annual general meeting.

Mr. Andy Lau, CEO and Executive Director of Expert Systems, said: “Despite the challenging business environment, the Group has delivered a resilient performance in FY2024. Leveraging our strong foundation and exceptional products, solutions and services, we have adeptly navigated the dynamic market landscape. Throughout the past fiscal year, our two core businesses have exhibited steady growth, while our AI business has successfully launched new products, starting to contribute to our revenue.”

Business Review

IT Infrastructure Solutions

Regarding the IT infrastructure solutions business, the Group believes that enterprises and institutions will continue to adopt digital transformation to enhance operational efficiency, leading to a strong demand for IT-related one-stop solutions. Particularly, given the escalating cybersecurity incidents, the Group is committed to persistently deploying world-class cybersecurity solutions to safeguard the customers’ valuable IT assets. It is worth mentioning that the Group is customizing robust IT infrastructure tailored for our own developed Generative AI (“GenAI”) applications to meet customers’ diverse needs. To align with market trends and significant demand, the Group will prioritize resources in two key business opportunities of Cybersecurity and GenAI, and strive to provide higher value and more comprehensive total solutions to customers.

IT Infrastructure Management Services

The Group’s IT infrastructure management services business foresees sustained demand across the Asia-Pacific region. This includes IT outsourcing, helpdesk support, workflow automation services, and IT hardware maintenance for enterprises and institutions. The Group plans to extend its services into Managed Professional Service to further enhance its range of managed services offerings. This dedicated facility will leverage the existing resources of its service desk centres, enabling to extension of the managed services from endpoints and devices to encompass network systems and server host systems for valued customers.

The group currently operates service centers in Guangzhou and Kuala Lumpur. The services are provided in seven languages, handling over 60,000 cases per month. The Group plans to expand the capacity of the Guangzhou service desk center and relocate it to a new facility, creating a synergistic effect with the Kuala Lumpur service desk center. This will effectively balance resources across different regions and enhance the ability to provide flexible services to meet diverse customer needs.

AI Business

Regarding the AI business, the Group has successfully developed a range of GenAI products based on cloud and on-premises large language models for its corporate and institutional customers. The Group’s GenAI product series, namely ChatSeries, encompasses a variety of GenAI functions, including ChatEnquiry, ChatSerivceDesk and ChatMinutes etc. During the pre-launch stage of this product series, the group received a large number of inquiries reflecting a fervent market demand. In addition, the Group announced last year the establishment of the strategic partnership with Lenovo Hong Kong, with a specific focus on serving the primary and secondary school market. In fact, the Group has developed the SmartSeries product line, which includes SmartAqua, SmartRetail, and SmartHome, providing AI labs setups and relevent training courses tailored to primary and secondary schools. The group is currently collaborating with Lenovo Hong Kong to jointly market the SmartSeries AI products.

Mr. Lau, concluded: “Looking ahead, besides continue to grow our core businesses in providing one-stop IT solutions for the public and private sectors in the Asia-Pacific region, we will also continue to actively advance our AI products and solutions, aiming to bring strong growth momentum to the group. We are optimistic about the future, and we will eagerly to explore new growth opportunities with an open and innovative mindset, in order to achieve the company’s long-term sustainable development goals.”

Read the announcement of the detailed results here: https://www.expertsystems.com.hk/wp-content/uploads/2024/06/EW08319-ann-1.pdf

Highlights:

- Revenue for the year ended 31 March 2024 (the “Reporting Year” or “FY2024”) increased by approximately 11.8% from that for the year ended 31 March 2023 (the “Corresponding Year” or “FY2023”) to approximately HK$991.0 million.

- Gross profit for the Reporting Year increased by approximately 9.6% from the Corresponding Year to approximately HK$152.7 million.

- Profit for the year attributable to owners of the Company for the Reporting Year decreased by approximately 21.8% to approximately HK$15.4 million as compared to the Corresponding Year. (Note)

- Basic earnings per share decreased by approximately 22.0% from approximately HK2.45 cents for the Corresponding Year to approximately HK1.91 cents for the Reporting Year.